This could be considerably robust to realize when the company doesn’t only have to carry on good phrases with suppliers but also needs to think about its inner working capital and obtainable money flows. Nonetheless, you must try to strike a balance as taking as long as attainable to pay creditors can end result in the company having more money which is good for working capital and out there money flows. It is essential for you to remember of the common payable period so as for you to be ready to take essential action when the time involves pay creditors. A business’s average assortment period is the common amount of time it takes that business to gather funds owed to by its shoppers. Exercise ratios measure how efficiently an organization performs day-to-day duties, such us the collection of receivables and management of stock. To conclude, the payment period accounts for a sensor that points how well a company can utilize its money flow to cowl short-term needs.

Understanding the Common Fee Period allows businesses to proactively manage their credit score policies, cash flows, and total monetary health. It also supplies priceless data to collectors and investors in regards to the company’s short-term liquidity and operational efficiency. To illustrate, consider a retail firm that negotiates a 45-day cost term with its suppliers however sometimes pays in 30 days. While this will likely foster goodwill, the company could probably improve its money flow by utilizing the complete 45 days, particularly if it might invest that money in short-term, interest-bearing devices.

What Is The Method Of The Common Payment Period?

Prospects who don’t discover their creditors’ phrases very friendly might choose to hunt suppliers or service suppliers with more lenient fee terms. The common assortment interval is an accounting metric used to symbolize the average variety of days between a credit sale date and the date when the purchaser remits payment. A company’s common collection interval is indicative of the effectiveness of its AR administration practices.

It is a fragile stability that requires cautious consideration of each the industry context and the company’s particular circumstances. Collecting its receivables in a relatively short and affordable period of time provides the company time to repay its obligations. When analyzing common collection period, be aware of the seasonality of the accounts receivable balances. For instance, analyzing a peak month to a sluggish month could result in a really inconsistent common accounts receivable balance that will skew the calculated amount. An average assortment period of 30 days indicates that the company usually collects its accounts receivable within a 30-day timeframe.

What’s The Relationship Between App And Money Conversion Cycle?

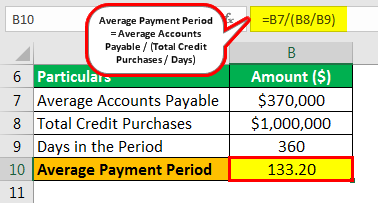

This amount is then divided into the accounts payable the company has amassed in a single year, a total which may be found on a steadiness sheet. Utilizing the same example, think about that the company’s accounts payable for the 12 months is $60,000 USD. The common cost period is set https://www.simple-accounting.org/ by dividing the accounts payable by the average credit purchases per day. In this case, it will be $60,000 USD divided by $2,000 USD, which yields a quotient of 30. The common payment period is a multifaceted metric that requires cautious consideration and management.

What Is Taken Into Account A Great Average Fee Period?

The common cost period might help the administration team see how environment friendly the corporate has been over the previous year with such credit score choices. Divide an quantity calculated in step 1 (average payable) with the per-day gross sales calculated in step 2 (credit sales per day). The determine obtained is a priceless insight that helps to evaluate the typical cost period of the business.

If the industry common is 60 days, the company is slower than average, which could be a strategic determination or an indication of cash flow difficulties. Average payment interval within the above scenario seems for instance a somewhat long fee interval. Assume that Clothing, Inc. can receive a 10% discount for paying inside 60 days from considered one of its primary suppliers. The firm administration team would need to evaluate this to see if there’s adequate money flow to cowl the acquisition in 60 days. If it can, that could make for a pleasant improve to the bottom line, as 10% is a large distinction within the clothing trade. To calculate, first locate the accounts payable info on the balance sheet, situated under present liabilities section.

- It’s essential to note that shorter working capital is extra desirable from a financial standpoint.

- If the business average is 30 days, the corporate is slower in fee, which could probably be a sign of cash circulate points or a strategic financial determination.

- Assume that Clothing, Inc. can obtain a 10% discount for paying inside 60 days from considered one of its major suppliers.

- The common assortment period is carefully related to the accounts turnover ratio, which is calculated by dividing total web gross sales by the average AR stability.

- Any adjustments that could happen to this quantity have to be evaluated in detail to find out the quick results on the money flow.

You can use the average cost interval calculator beneath to rapidly discover the average amount of days an organization takes to pay its vendors by getting into the required numbers. One Other use for the common payment interval is to discover out how effectively an organization uses its credit score in the quick time period. If an organization usually pays its distributors rapidly and on time would possibly result in the company being provided better fee phrases from new or present distributors.

The optimal strategy will differ depending on the corporate’s specific financial state of affairs, industry standards, and the financial environment. By carefully analyzing these elements, companies can leverage the APP to reinforce their monetary stability and operational effectivity. By understanding and applying these benchmarks, firms could make informed decisions about their payment policies and techniques. A longer than average APP might afford an organization larger liquidity, nevertheless it may additionally pressure supplier relationships or sign potential cash circulate issues. Conversely, a shorter APP might point out environment friendly payables administration however might also recommend that the corporate isn’t totally leveraging obtainable credit score facilities. This means, on common, the corporate takes roughly 61 days to pay its suppliers.

Initially secure at 3 days for the fiscal years ending in 2020 and 2021, the period extended to 4 days from 2022 onward and maintained at four days through 2025. This aligns with the trend observed in the receivables turnover ratio, as a longer assortment interval usually accompanies a lower turnover ratio. This decreasing receivables turnover ratio means that the company has been amassing its receivables much less frequently over time, which may indicate a longer time frame for converting credit sales into money. There are several benefits that come to an organization that tracks their common fee period. However the largest profit comes from the common cost period being a solvency ratio.

Divide the results of dividing the whole credits by the point period by the typical accounts payable. The finish end result provides you the average cost interval ratio, which can give you necessary information about the cash flow processes and general monetary health of your group. The Typical Payment Period is a vital finance term as it supplies perception right into a company’s cost pattern to its collectors, which is crucial for money circulate management. From a provider’s perspective, a shorter APP is preferable as it ensures quicker cost, enhancing their money flow and lowering credit score risk.